7 Income-Generating Options Strategies For Bitcoin Owners That Aren't Covered Calls

First off, let me state the obvious: this is not financial advice—you are liable for your financial decisions, not me. Don't do anything stupid with your money. Make sure you study options thoroughly before executing these trades. This post is for informational purposes only.

Ok, now that that's out of the way, let's get into it...

I think it's wise to use options strategies to generate income that you can plow right back into your Bitcoin stack. It's like nearly automated stacking fuel. This comes with risks, of course, but if you approach your options strategies intelligently and professionally, you can come out ahead—increasing your stack.

Most people don't want to try the options route because they think they'll be tying up too much capital to do it (instead of owning Bitcoin directly with that capital). For example, selling Covered Calls requires that you own the underlying. If you want to start utilizing Covered Calls on $IBIT or $MSTR to generate some income, you'll be looking at locking up a lot of capital.

Covered calls have too much opportunity cost associated with them. I'd rather own the Bitcoin. Fortunately, you don't need to use them.

Here are 7 income-generating strategies that have two great qualities:

- They don't require ownership of the underlying stock or ETF shares so you don't need to reduce your Bitcoin stack to tie up capital in the underlying.

- They result in a "net credit" when initiating the trade, meaning money is deposited into your account.

Be sure to study each strategy thoroughly on your own since they all have their unique risks and nuances. The following information is simply to introduce you to the strategies and their key points. If you're brand new to options, you'll need to do a lot of study. Don't Panic!

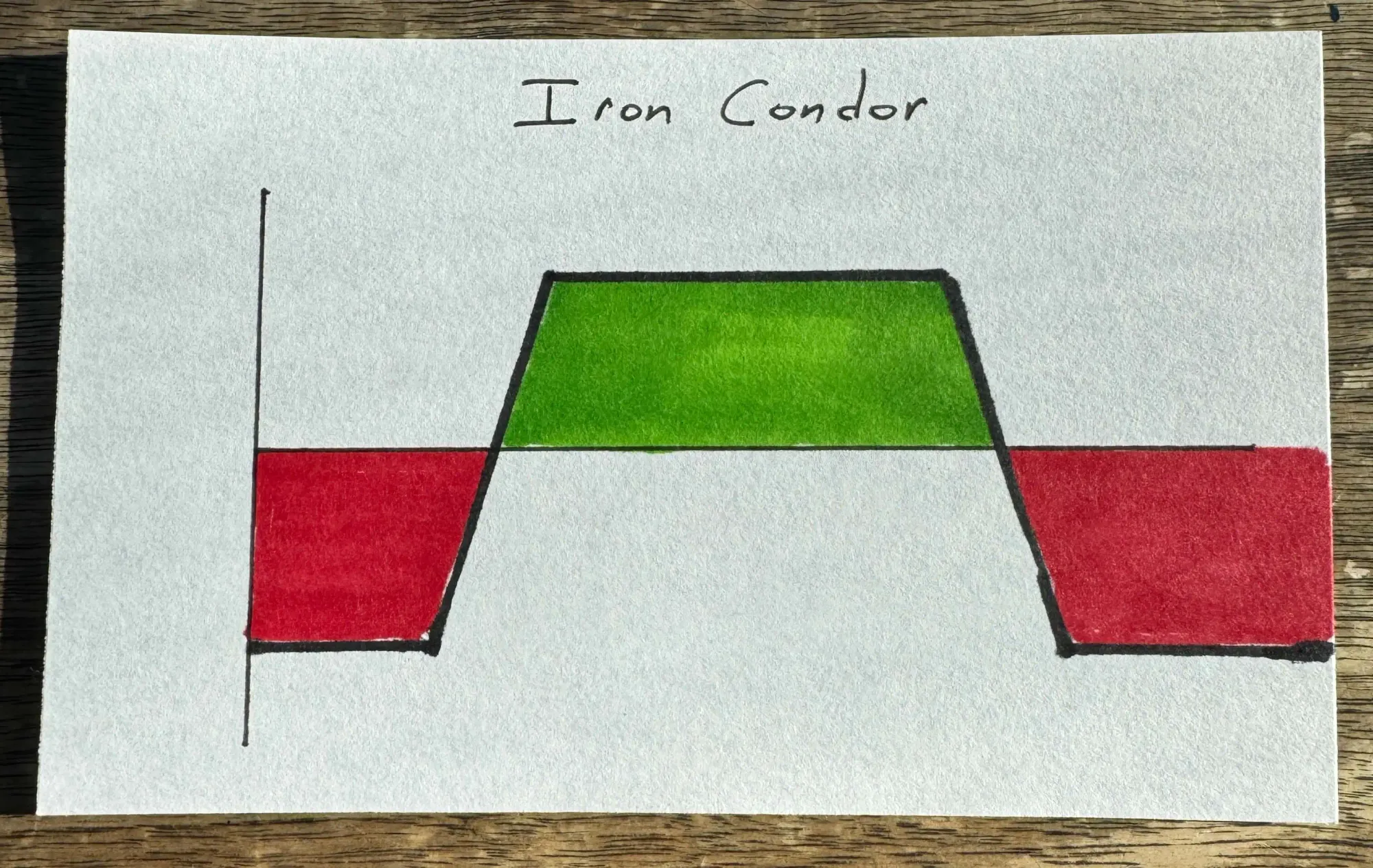

Strategy #1 – Iron Condor

Description: Combines a bull put spread (sell put + buy lower put) and a bear call spread (sell call + buy higher call). Profits if the stock stays within a specific range.

Risk: Limited to the width of one spread minus the net credit received.

Income Source: Net credit collected from selling both spreads.

Assignment Risk: Assignment is possible if the short put or short call is in-the-money. Protective long options cap the risk.

Consider this strategy when: You expect low volatility and believe the stock price will remain within a predictable range.

Profits most when: The stock price stays within the range of the short strikes until expiration.

Payoff Diagram at Expiration (green is profit, red is loss)

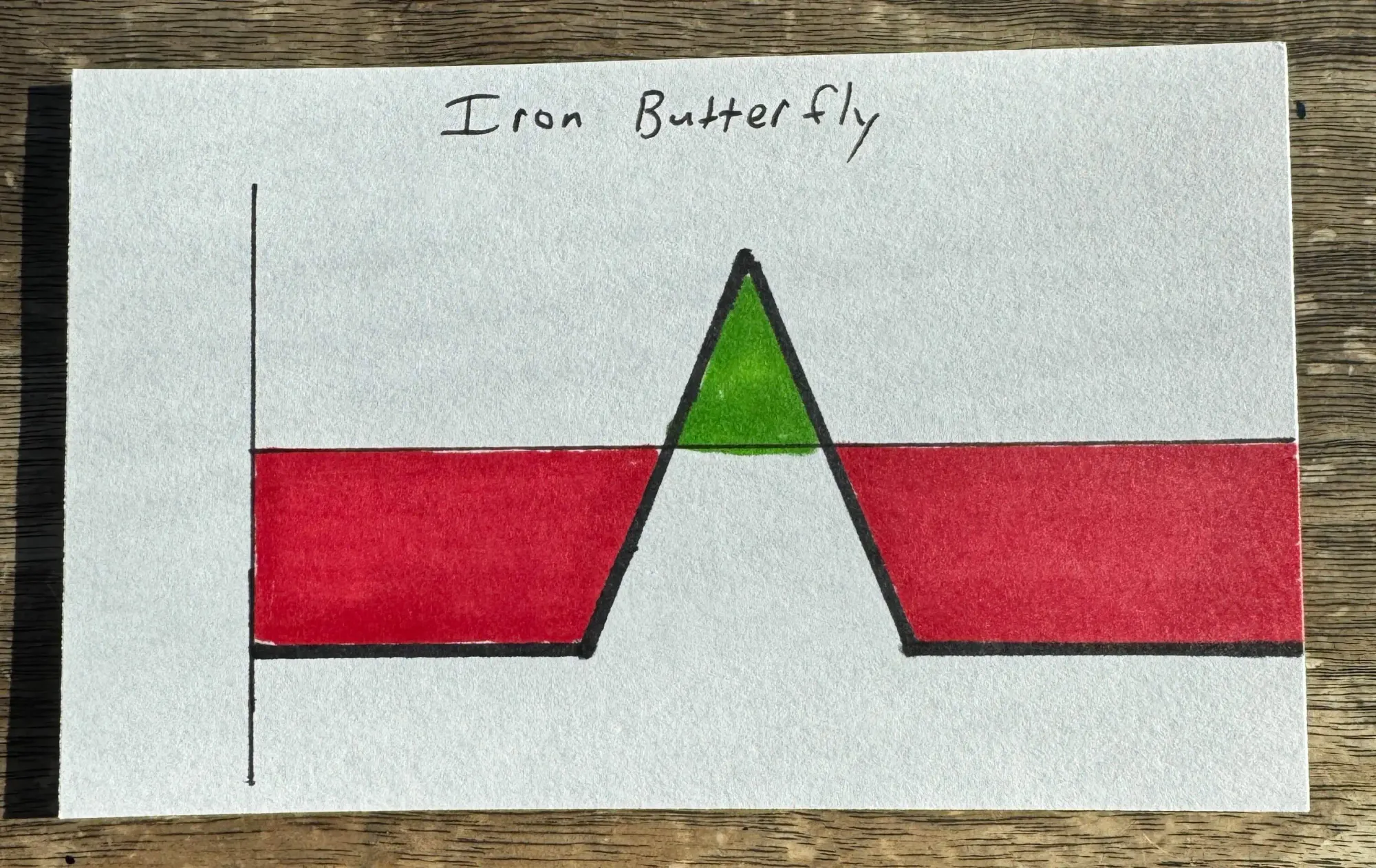

Strategy #2 – Iron Butterfly

Description: Sells a straddle (at-the-money call and put) and buys protective wings (out-of-the-money call and put). Profits if the stock stays near the at-the-money strike.

Risk: Limited to the width of the wings minus the net credit received.

Income Source: Net credit from the straddle minus the cost of the wings.

Assignment Risk: Assignment is possible on the short call or short put if in-the-money, but the long options offset the risk.

Consider this strategy when: You expect very low volatility and the stock to remain near the current price.

Profits most when: The stock price stays exactly at the strike price of the short options at expiration.

Payoff Diagram at Expiration (green is profit, red is loss)

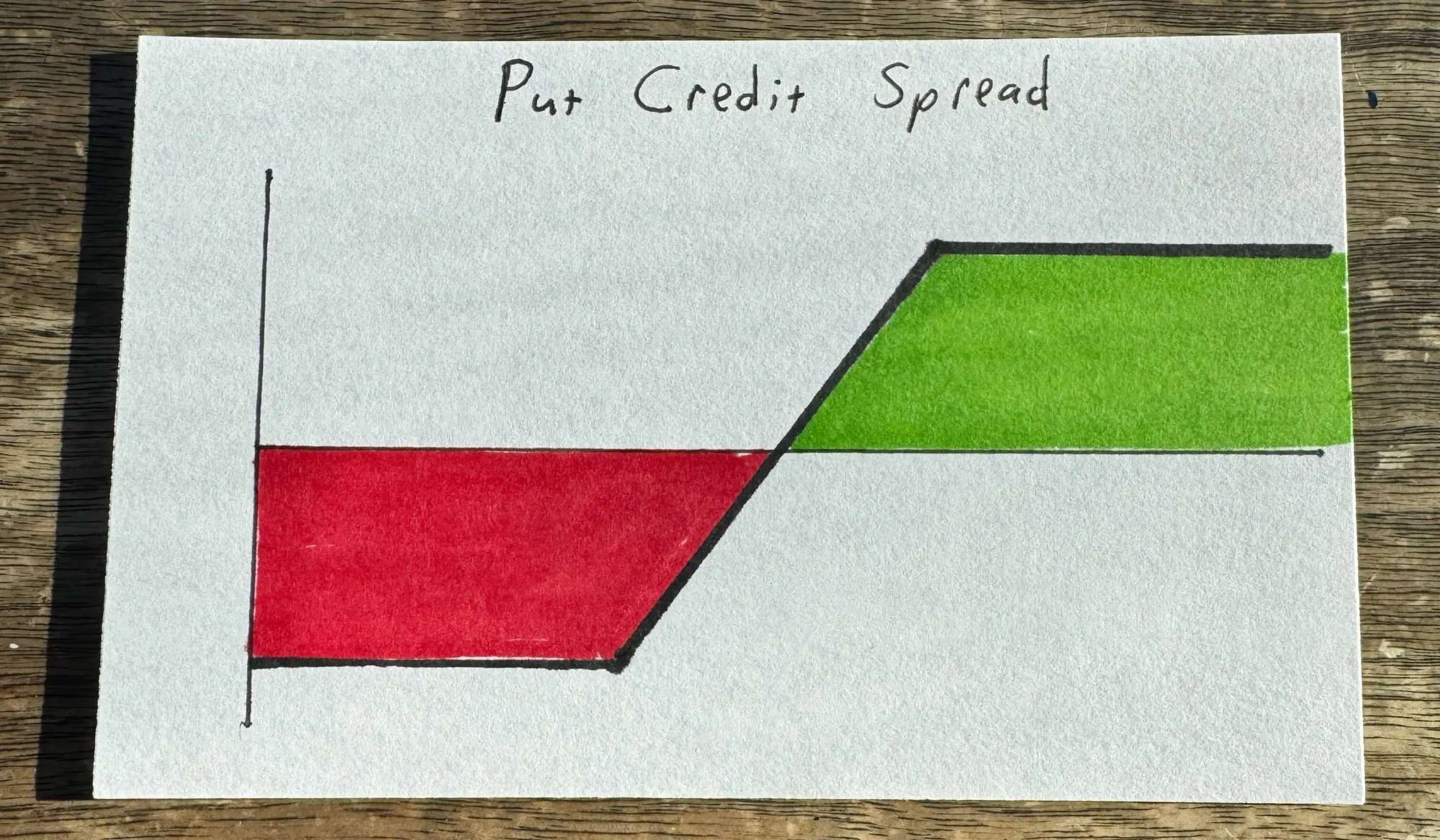

Strategy #3 – Put Credit Spread

Description: Sells a higher strike put and buys a lower strike put. Profits if the stock stays above the higher strike.

Risk: Limited to the difference between the strikes minus the net credit received.

Income Source: Net credit from selling the spread.

Assignment Risk: Assignment is possible if the stock price falls below the short put strike, but the long put limits the risk.

Consider this strategy when: You are moderately bullish on the stock or believe it will not fall significantly.

Profits most when: The stock price remains above the short put strike until expiration.

Payoff Diagram at Expiration (green is profit, red is loss)

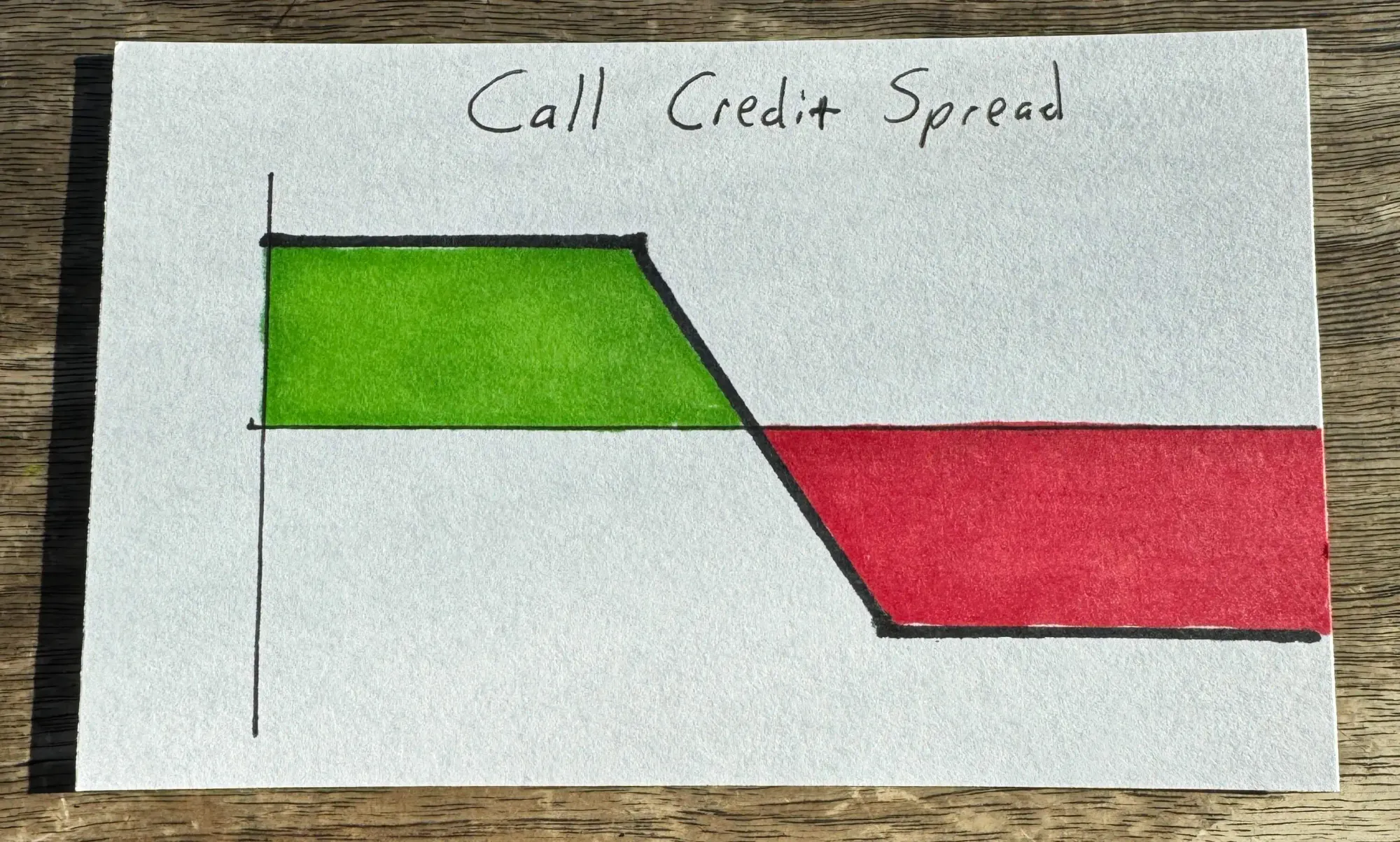

Strategy #4 – Call Credit Spread

Description: Sells a lower strike call and buys a higher strike call. Profits if the stock stays below the lower strike.

Risk: Limited to the difference between the strikes minus the net credit received.

Income Source: Net credit from selling the spread.

Assignment Risk: Assignment is possible if the stock price rises above the short call strike, but the long call limits the risk.

Consider this strategy when: You are moderately bearish on the stock or believe it will not rise significantly.

Profits most when: The stock price remains below the short call strike until expiration.

Payoff Diagram at Expiration (green is profit, red is loss)

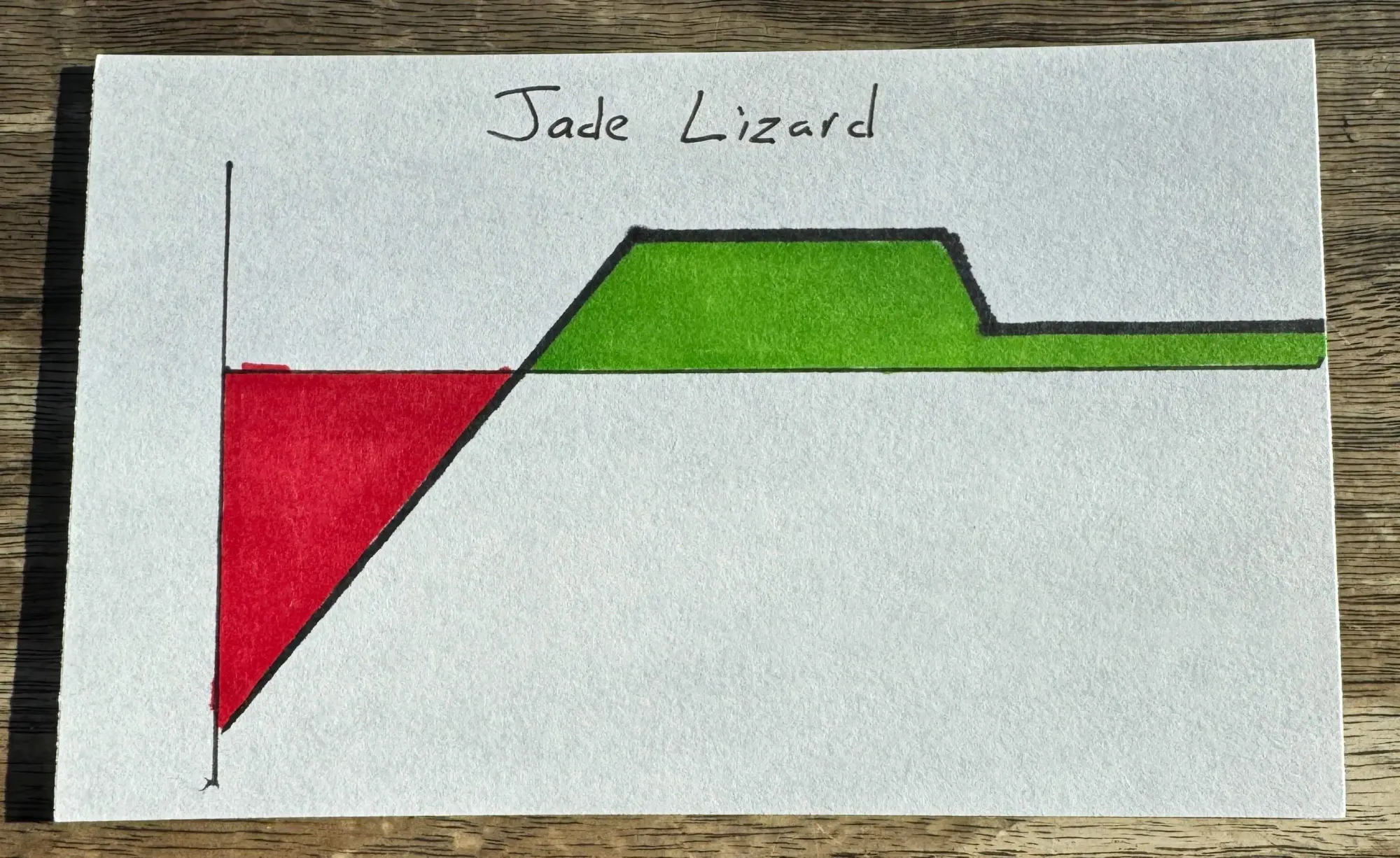

Strategy #5 – Jade Lizard

Description: Combines a short put and a short call spread. Profits from neutral to slightly bullish movement.

Risk: Limited to the downside risk of being assigned stock from the short put. No upside risk due to the structure.

Income Source: Net credit from the short put and call spread.

Assignment Risk: The short put could be assigned if the stock price falls below the strike. Close or roll to avoid assignment.

Consider this strategy when: You are neutral to slightly bullish and want to generate income with capped risk.

Profits most when: The stock price remains above the short put strike and below the short call spread until expiration.

Payoff Diagram at Expiration (green is profit, red is loss)

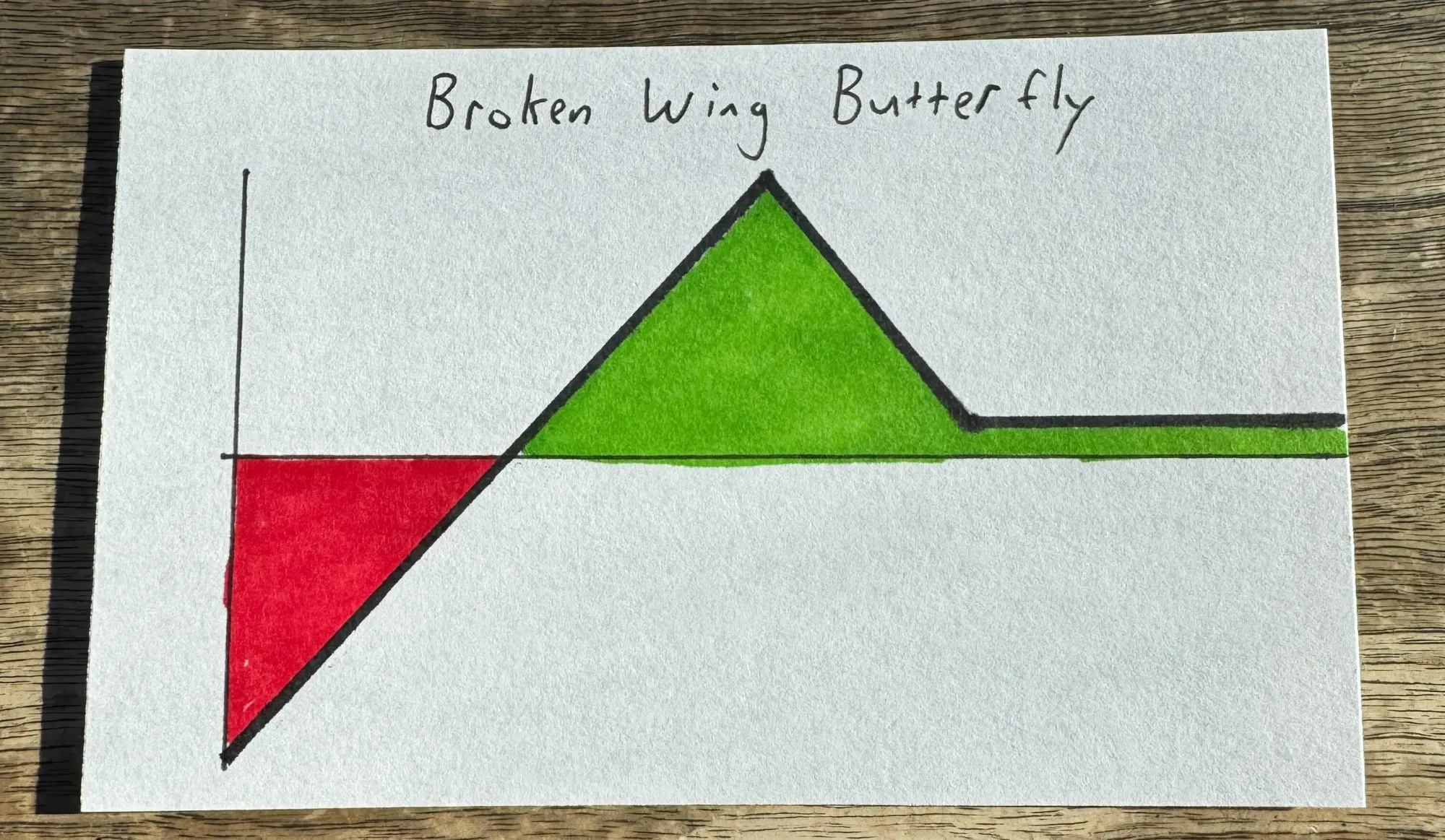

Strategy #6 – Broken Wing Butterfly

Description: Similar to a butterfly spread but with one wing farther from the center strike, creating a directional bias. Profits from low volatility with slight movement in one direction.

Risk: Limited to the difference between the wider and narrower wings minus the net credit received.

Income Source: Net credit from selling the middle strikes.

Assignment Risk: The short call or short put could be assigned if in-the-money. Protective long options mitigate the risk.

Consider this strategy when: You have a slight upward directional bias and expect low volatility.

Profits most when: The stock price moves higher and expires near the middle strike.

Payoff Diagram at Expiration (green is profit, red is loss)

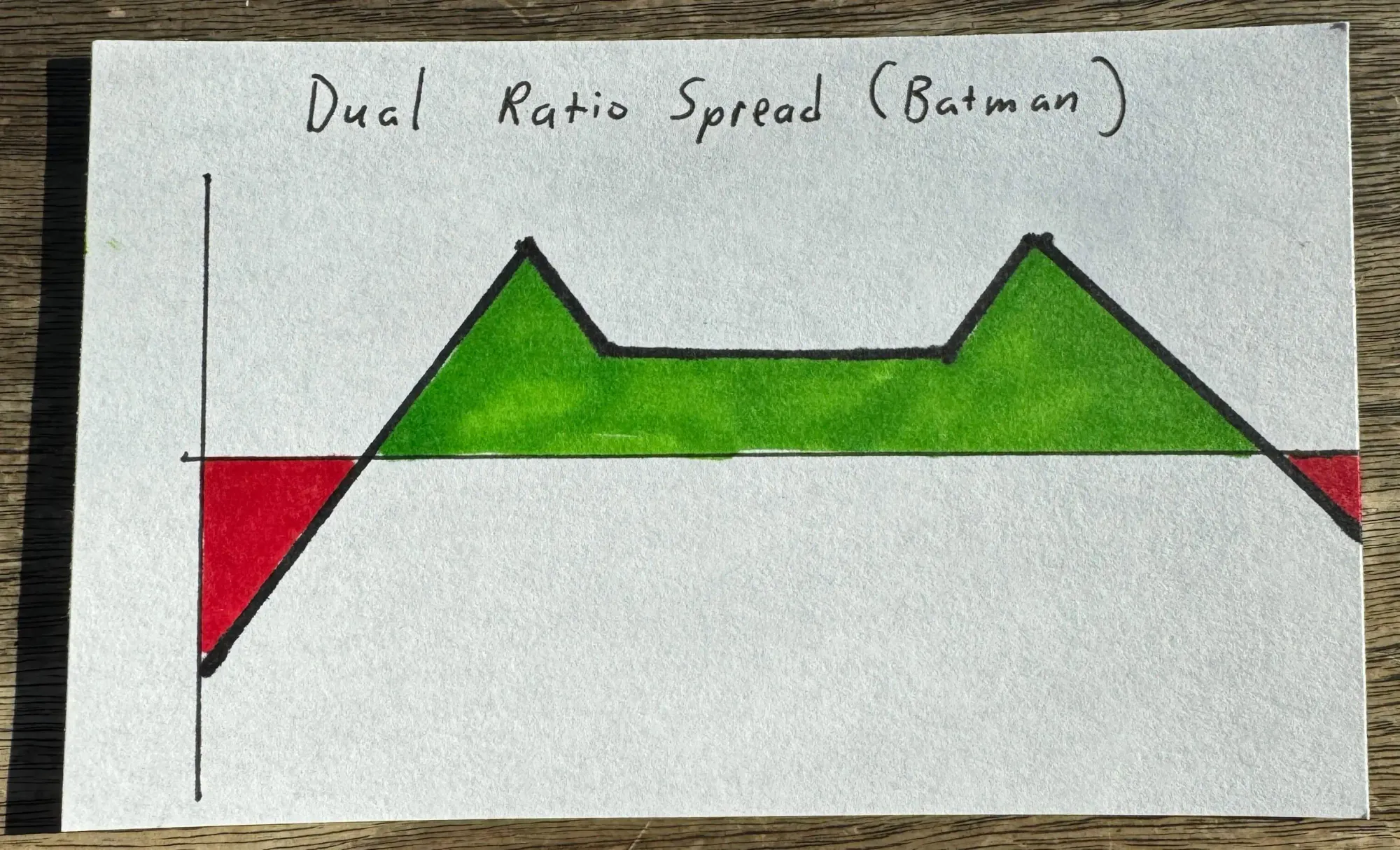

Strategy #7 – Dual Ratio Spread (Batman Spread)

Description: Sells two ratio spreads on both sides of the stock price (e.g., call ratio spread + put ratio spread). Profits from low volatility within a range.

Risk: Limited to the defined risk of each spread minus the net credit received.

Income Source: Net credit from selling the options.

Assignment Risk: The short call or short put could be assigned if in-the-money. Protective long options mitigate the risk.

Consider this strategy when: You expect the stock to stay within a specific range and have no strong directional bias.

Profits most when: The stock price stays within the combined range of the short strikes until expiration.

Payoff Diagram at Expiration (green is profit, red is loss)

Enjoy! And make sure to do your own research. Options are NOT a free lunch. Be sure you understand all the risks involved with the strategies before executing actual trades with real money. With all of these strategies it is possible to lose money, profit is never guaranteed.